Embark on a journey to master the art of comparing car finance deals like a pro. This guide is designed to provide you with valuable insights and tips to make informed decisions when navigating the world of car financing.

Exploring the intricacies of interest rates, loan terms, and negotiation tactics can help you secure the best deal that suits your financial needs.

Overview of Car Finance Deals

Car finance deals refer to the various options available to consumers for financing the purchase of a vehicle. These deals typically involve borrowing money from a lender to buy a car and paying it back over a set period of time with interest.It is crucial to compare car finance deals like a pro to ensure that you get the best possible terms and save money in the long run.

By comparing different deals, you can find the one that offers the lowest interest rates, favorable repayment terms, and overall cost.

Types of Car Finance Deals

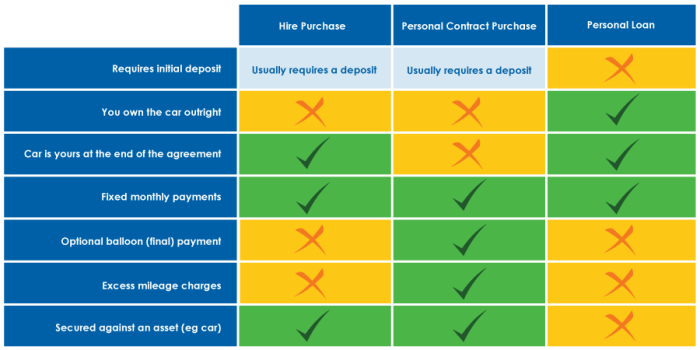

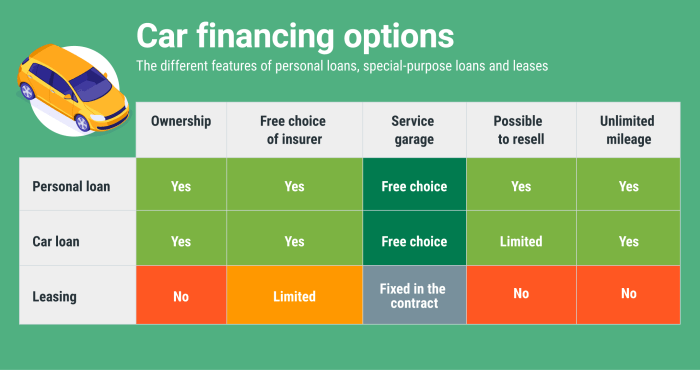

- Hire Purchase (HP): With HP, you pay a deposit and then make monthly payments until you've paid off the full value of the car. Once all payments are made, you own the vehicle.

- Personal Contract Purchase (PCP): PCP involves lower monthly payments as you're essentially leasing the car. At the end of the contract, you have the option to buy the car by making a final payment, return it, or upgrade to a new model.

- Personal Loan: This involves borrowing a fixed amount of money from a bank or lender to purchase a car. You then repay the loan in fixed monthly installments with interest.

- Leasing: Car leasing involves paying a fixed monthly fee to use a car for an agreed-upon period. At the end of the lease, you return the car without owning it.

Factors to Consider When Comparing Car Finance Deals

When comparing car finance deals, there are several key factors to take into consideration to ensure you are getting the best option for your needs.

Interest Rates and Total Cost Impact

Interest rates play a crucial role in determining the total cost of your car finance deal. A lower interest rate can save you a significant amount of money over the life of the loan. It is essential to compare interest rates from different lenders to find the most competitive option.

Keep an eye out for any promotional rates that may change after a certain period, leading to higher costs in the long run.

Loan Terms and Monthly Payments

The loan term refers to the length of time you have to repay the loan. Shorter loan terms typically come with higher monthly payments but lower overall interest costs. On the other hand, longer loan terms may have lower monthly payments but result in paying more in interest over time.

Consider your budget and financial goals when choosing the loan term that works best for you.

Additional Fees or Charges to Watch Out For

In addition to interest rates, lenders may also charge additional fees or costs that can impact the total amount you pay. These fees can include origination fees, prepayment penalties, late payment fees, and more. Be sure to read the fine print and understand all the fees associated with the car finance deal to avoid any surprises down the road.

Researching Car Finance Options

When it comes to finding the best car finance deals, conducting thorough research is crucial. Here are some tips on where to find car finance deals and how to compare them effectively.

Where to Find Car Finance Deals

- Start by checking with local banks and credit unions, as they often offer competitive rates for car loans.

- Online lenders and financial institutions also provide car finance options, so be sure to explore these avenues as well.

- Dealerships may have special financing offers, but it's important to compare these with other options to ensure you're getting the best deal.

Checking Credit Scores Before Applying

- Before applying for car finance, it's essential to check your credit score. A higher credit score can help you qualify for better interest rates and loan terms.

- Monitor your credit report for any errors or discrepancies that could potentially impact your ability to secure favorable financing.

- Improving your credit score before applying for car finance can save you money in the long run, so it's worth the effort.

Step-by-Step Guide to Comparing Offers

- Collect quotes from multiple lenders, including banks, online institutions, and dealerships.

- Compare interest rates, loan terms, and any additional fees associated with each offer.

- Calculate the total cost of the loan, including interest payments, to determine the most affordable option.

- Consider the flexibility of repayment options and any penalties for early repayment.

- Select the offer that best fits your financial situation and long-term goals.

Negotiating with Lenders

When it comes to car finance deals, negotiating with lenders can help you secure better terms and rates that fit your budget. By understanding how to approach negotiations and what strategies to employ, you can potentially save money and get a more favorable deal.

Benefits of Pre-Approval

- Pre-approval can give you a clear picture of how much you can borrow and what interest rates you qualify for, helping you set realistic expectations when negotiating with lenders.

- Having pre-approval shows lenders that you are a serious and prepared buyer, which can give you leverage in negotiations to potentially secure better terms and rates.

- Pre-approval can also speed up the car buying process, as you already have a financing offer in hand, allowing you to focus on finding the right car without worrying about financing.

Strategies for Getting the Best Deal

- Do Your Research: Before negotiating with lenders, make sure to research current interest rates, loan terms, and any special offers available in the market. This will give you a better understanding of what to expect and what is considered a good deal.

- Compare Offers: Get quotes from multiple lenders and compare them to see which one offers the most favorable terms. Use this information to negotiate with lenders and potentially get them to match or beat other offers.

- Focus on Total Cost: When negotiating, focus on the total cost of the loan, including interest rates, fees, and any other charges. Sometimes, a lower interest rate may not necessarily mean a better deal if there are other hidden costs involved.

- Be Willing to Walk Away: Don't be afraid to walk away from a deal if it doesn't meet your expectations. By being prepared to walk away, you show lenders that you are serious about getting a good deal and may prompt them to offer you better terms to keep your business.

Understanding the Fine Print

When it comes to car finance deals, understanding the fine print is crucial to avoid any surprises down the road. It is essential to carefully read and comprehend all the terms and conditions Artikeld in the agreement before signing on the dotted line.

Importance of Reading and Understanding Terms

- Ensure you are aware of the interest rate, repayment schedule, and any additional fees associated with the car finance deal.

- Understand the consequences of missing payments or defaulting on the loan to avoid any financial pitfalls.

- Clarify any unclear terms or clauses with the lender to prevent misunderstandings in the future.

Common Pitfalls to Avoid

- Avoid overlooking hidden fees or charges that could significantly impact the overall cost of the car finance deal.

- Watch out for prepayment penalties that may restrict your ability to pay off the loan early without incurring extra costs.

- Beware of balloon payments that require a large lump sum at the end of the loan term, potentially catching you off guard.

Examples of Clauses to Pay Attention to

-

Grace Period: Understand if there is a grace period for late payments and the associated fees.

-

Default Terms: Know the repercussions of defaulting on the loan, such as repossession of the vehicle.

-

Insurance Requirements: Check if specific insurance coverage is mandatory as part of the car finance agreement.

Closure

In conclusion, mastering the skill of comparing car finance deals can save you money and ensure you make well-informed choices. Armed with the knowledge from this guide, you can confidently navigate the complex landscape of car financing options.

Helpful Answers

What should I prioritize when comparing car finance deals?

When comparing car finance deals, prioritize understanding the total cost, including interest rates, loan terms, and any additional fees involved.

Is it necessary to check my credit score before applying for car finance?

Yes, checking your credit score before applying for car finance is crucial as it gives you an idea of what interest rates and loan terms you may qualify for.

How can I negotiate for better terms and rates with lenders?

To negotiate for better terms and rates, be prepared with competitive offers from other lenders, highlight your creditworthiness, and consider seeking pre-approval to strengthen your position.

What are some common pitfalls to avoid when reviewing car finance agreements?

Common pitfalls include overlooking hidden fees, not understanding the terms and conditions, and rushing through the agreement without careful scrutiny.

Which clauses or terms in car finance agreements require careful attention?

Pay close attention to clauses related to early repayment penalties, interest calculation methods, and any clauses that may impact your ability to refinance in the future.